Employee Stock Option Plan

Author: – Ms. Shilpa Agarwal

In this article, we will try to explain In brief how ESOP works.

- DEFINITION:

As per Sec.2(37) of the Companies Act, 2013, ESOP means the option given to the directors, officers or employees of a company or of its holding company or subsidiary company, which gives such directors, officers or employees, the benefit or right to purchase, or to subscribe for, the shares of the company at a future date at a pre-determined price;

- ELIGIBILITY :

- a) Inclusions:

- 1. Permanent employee working in India or outside India;

- 2. Director of the Company, whether a Whole-time Director or not, but excluding Independent Director;

- 3. Employee as defined in 1 & 2 above of a subsidiary in India or outside India or of a holding company.

- b) Exclusions:

But does not include the following categories of employees:

- 1. An employee who is a Promoter or person belonging to the promoter group

- 2. A Director who either himself or through his relatives or any Body corporate, directly or indirectly holds more than 10% of outstanding equity shares of the Company

- c) Exception:

The above two exclusions do not apply to a registered start-up for 10 years from the date of its incorporation or registration.

- BENEFITS OF ESOP:

- Employer:

- 1. It helps in rewarding employees for their contribution, performance and tenure

- 2. It helps in retaining employees for long-term

- 3. It motivates employees to perform better

- 4. It helps in attracting the best talent in the industry

- 5. It helps in reducing the burden on cash flows in the initial years of formation and growth

- Employee:

- 1. It enhances the motivation levels of the employees

- 2. It helps in creating a wealth of the employees

- 3. It acts as a retirement benefit plan

- 4. It helps them align with Company’s goals and objectives

- 5. It instils a sense of belongingness towards the Company as future shareholders

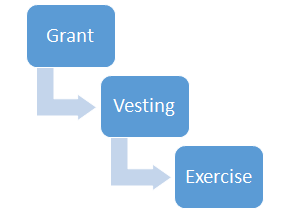

- STAGES OF ESOP:

ESOP has the following stages during its lifecycle:

- 1. Grant: First, the Company grants options to employees i.e., issues ESOPs to employees which makes them eligible to exercise the same in future;

- 2. Vesting: Vesting refers to the period during which granted options can be exercised. There should be a minimum gap of one year between grant and vesting of options.

- 3. Exercise: Lastly, Exercise under which options become shares. Employees have to pay an exercise price to exercise the options and on exercising the options, they become shareholders of the Company.

- TAXATION:

We need to understand the Taxation aspect of the issue and exercise options from the Employer and Employee perspective.

- On Employer:

To the Employee, there is no tax on issue or exercise of options. Options cost shall be accounted for as compensation expense and allowed as a deduction in the Profit & Loss Account

- On Employee

To the Employee, there is taxation at two stages:

- a) At the time of exercise (Prerequisite tax):

The difference between the fair value on the date of exercise and the exercise price is treated as perquisites and added to the salary of the employee. Tax is deducted on the same by the Employer.

As per Finance Act, 2022, eligible Start-ups are allowed to defer the deduction of TDS on the “Perquisite” component pertaining to ESOP added to salary for 14 days from the earlier of the following:

- i. after the expiry of 48 months from the end of the relevant assessment year; or

- ii. from the date of the sale of shares acquired pursuant to ESOP by the employee; or

- iii. from the date of the taxpayer ceases to be an employee of the Company.

- b) At the time of sale:

When the employee sells shares acquired pursuant to the exercise of options, capital gains shall be levied, short-term or long-term depending on the period of holding. For this, the cost of acquisition shall be taken as the fair value on the date of exercise and not the actual exercise price to avoid double taxation.

Leave A Comment